Paycheck calculator with overtime pay

Exempt means the employee does not receive overtime pay. One way you can affect your take-home.

Paycheck Calculator Finest Selection 63 Off Aarav Co

If youre already living well within your budget consider increasing your contributions to tax.

. Overview of Michigan Taxes Michigan is a flat-tax state that levies a state income tax of 425. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. You cant withhold more than your earnings.

Overtime Hours per pay period Dismiss. Another option to increase the size of your Ohio paycheck is to seek supplemental wages such as commissions overtime bonus pay etc. 33 it is mentioned that for overtime wages are to be paid at the rate of twice the ordinary rates of wages of the worker.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. 1500 Overtime pay per period. Please adjust your.

Please adjust your. Overtime Hours per pay period Dismiss. Overtime Hours per pay period Dismiss.

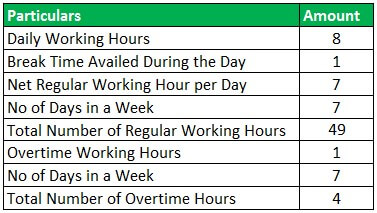

According to the law your normal working hours per day are 8-9 hours and these should not be more than 48 hours per week. How Your Iowa Paycheck Works. It can also be used to help fill steps 3 and 4 of a W-4 form.

Paycheck calculator to determine weekly gross earnings or income. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You cant withhold more than your earnings.

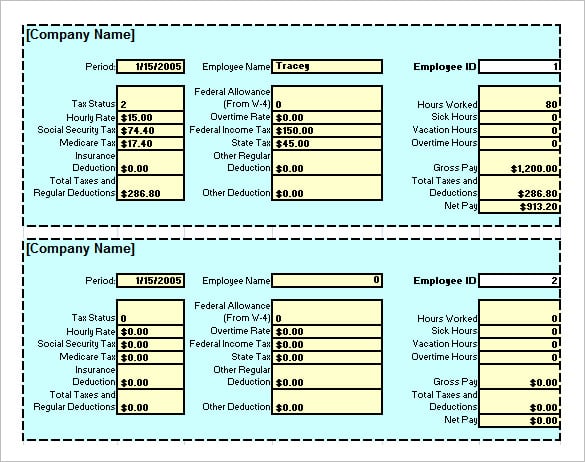

Creating free paystub using Online Paystub Generator can be used as a paystub calculator and paycheck calculator. Regardless of your pay frequency your employers will take out federal income taxes from your wages. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Then enter the employees gross salary amount. Overtime Hours per pay period Dismiss. Your estimated --take home pay.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. You cant withhold more than your earnings. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Please adjust your. These paycheck stubs can be used by employees as proof of their earnings employers can keep it for their records. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

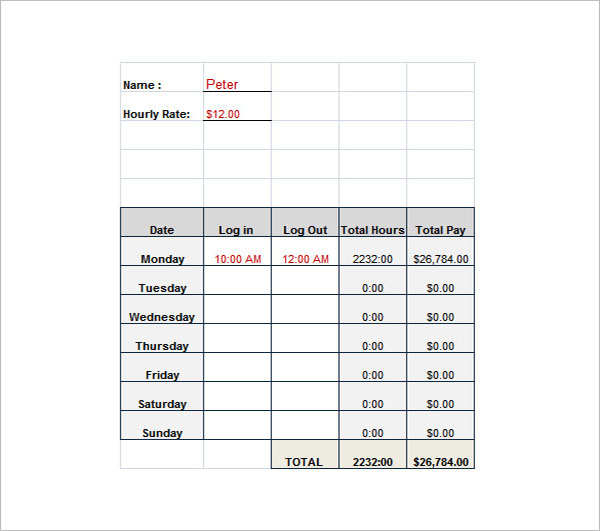

This hourly paycheck calculator helps you figure out the total gross pay or the weekly daily monthly or annual paycheck by considering hours worked pay rates. If you already know your gross pay you can enter it directly into the Gross pay entry field. While in case of the second tab called Hourly wage the equations used are.

New ACA information reporting 1095-C 1094-C. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your estimated --take home pay.

Overtime Hours per pay period Dismiss. Your estimated --take home pay. -Total gross pay Regular gross pay Overtime gross pay Double time gross pay.

The tax withholding rate on supplemental wages is a flat 35. This paycheck stub is print-ready. As it applies to all hourly rates of pay you are the one who ultimately determines how much compensation you receive from one hour of work.

FLSA non-exempt employees that are covered must receive overtime pay for hours worked over 40 in a workweek at a rate not less than one and a half times. With Online Pay Stubs you can instantly Create pay stub for free within minutes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 28 to 30 of the Act it is mentioned that no person employed in a mine shall be required or allowed to work in the mine for more than 10 hours in any day inclusive of overtime. Some people get monthly paychecks 12 per year while some are paid twice a month on set dates 24.

Register to save paychecks and manage payroll the first 3 months are free. Overtime pay is supported with straight double triple and time and a half pay rates. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Your estimated --take home pay. Who determines your rate of pay. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to.

In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. How to use Free Calculator.

A financial advisor in South Carolina can help you understand how taxes fit into your overall financial goals. If you arent sure how much to withhold use our paycheck calculator to find your tax liability. If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours.

Know more about labour laws of working hours and overtime pay in Pakistan. From there you would multiply your total overtime hours by your overtime rate to get your overtime pay for the pay period 1800 x 475 8550. Overtime 1 - Provides the Overtime 1 pay rate hours worked and earnings.

You cant withhold more than your earnings. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overtime 2 - Provides the Overtime 2 pay rate hours worked and earnings. Overview of Maryland Taxes Maryland has a progressive income tax.

How Your Paycheck Works. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You cant withhold more than your earnings.

Your gross pay will be automatically computed as you key in your entries. Overtime Calculator More - Free. This includes overtime commission awards bonuses payments for non-deductible moving expenses often called a relocation bonus severance and pay for accumulated.

By including the lunch and prayer time in hours of work working hours should not be greater than 9 hours a day. How You Can Affect Your South Carolina Paycheck. Overview of Georgia Taxes Georgia has a progressive income tax system.

Minimum Wages Act 1948 Under Sec. When you start a new job you fill out a W-4 form and the information on this form tells your employer how much to withhold in taxes from each of your paychecks. Please adjust your.

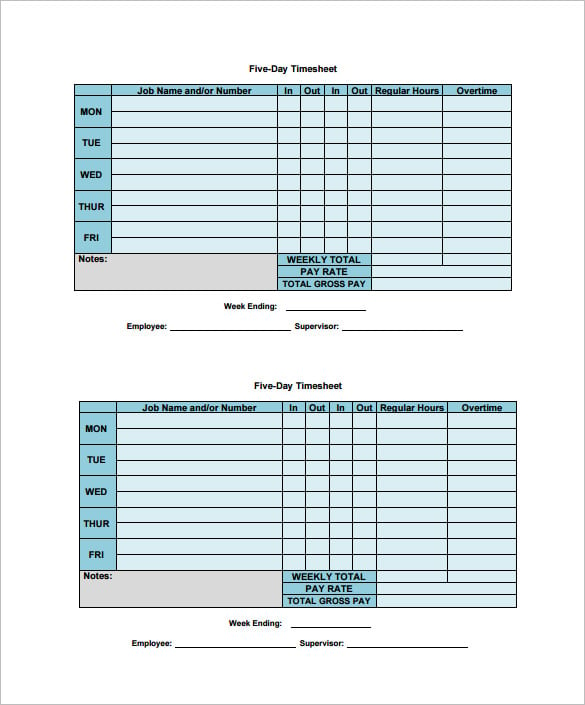

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator Us Apps On Google Play

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Paycheck Calculator Sale Online 51 Off Careconcept Nl

Paycheck Calculator Salary Calculator Net Income My Pay Mypercentcalculator

Salary To Hourly Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Salary To Hourly Free Online Paycheck Calculator

Paycheck Calculator Salaried Employees Primepay

11 Free Weekly Paycheck Calculator Excel Pdf Doc Word Formats

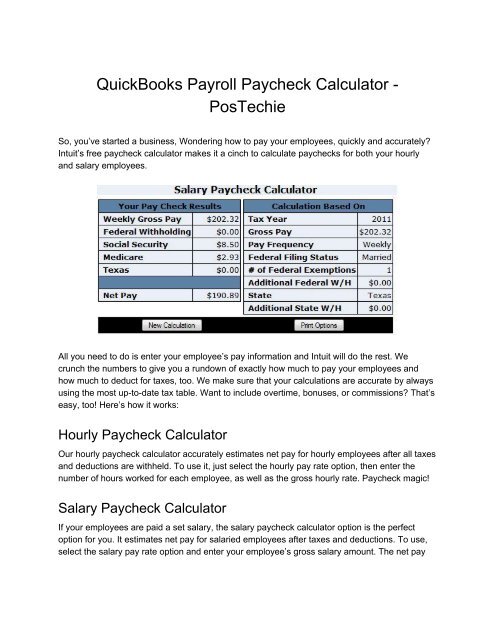

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks